Scorching summer may derail rural recovery, lead to a spike in inflation and interest rates

Along with heat stresses, the growing possibility of an El Nino condition may need a policy response, hit fiscal buffer

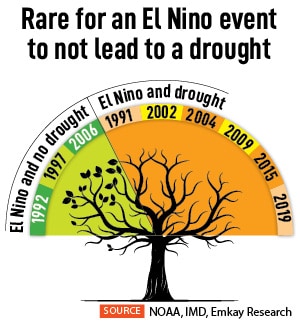

Since 1950, there have been 26 global El Nino years and 15 Indian drought years. However, the association between the two climatic phenomena appears to have strengthened since the 1980s, with an even stronger co-relation in the last 20 years.

Image: Prashant Waydande / Reuters

Since 1950, there have been 26 global El Nino years and 15 Indian drought years. However, the association between the two climatic phenomena appears to have strengthened since the 1980s, with an even stronger co-relation in the last 20 years.

Image: Prashant Waydande / Reuters

Scorching temperatures are likely to burn a hole in the pockets of Indian consumers this year as a cycle of heat waves, the early onset of summer and abnormal rainfall threaten to increase food prices, create short-term spikes in power prices and overall derail rural economy recovery. These climate risks and abnormalities may consequently need a policy response, thereby hitting key interest rates and toppling an already limping economy. Experts warn that heat stresses along with the growing possibility of an El Nino condition may not only impact inflation but also severely hit the fiscal buffer of the country.

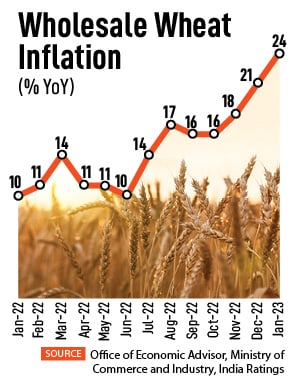

“We are once again witnessing an early onset of summer with February temperatures being the warmest in nearly 122 years. This could possibly shrivel wheat grain, akin to last year. Despite traction in Rabi sowing continuing to surpass comparable levels from a year ago all through the season to end 3.5 percent higher, there could be downside to wheat output pegged at 112.2 metric tonne as per the second advance estimates of the government. On the price front, any shortfall in output is likely to keep price pressures seen in cereals inflation over the last one year somewhat persistent,” says Yuvika Singhal, economist, QuantEco Research.

India has enjoyed a good Southwest monsoon successively over the last four years, but there could be a possible risk of El Nino conditions developing in the latter months of the summer in 2023.

“Typically, there is seen to be an adverse impact of El Nino on Southwest monsoon performance. While it is still early yet and we will continue to monitor El Nino risks closely, given the early warnings, policy efforts should be channelised to enhance straggling irrigation capacities in some of the agri-producing states such as Chhattisgarh, Karnataka, Maharashtra, Odisha and West Bengal,” Singhal adds.

Last month was the warmest February since 1877 with average maximum temperatures touching 29.54 degrees Celsius, India Meteorological Department (IMD) said. It has warned that most parts of the country are expected to experience above-normal temperatures while the southern peninsula and parts of Maharashtra are likely to escape the brunt of harsh weather conditions.

According to the IMD, average rainfall in India is most likely to be normal (83-117 percent of long period average) in March. Below normal rainfall is expected in most areas of northwest India, west-central India and some parts of east and northeast India. Normal to above-normal rainfall is likely over most parts of peninsular India, east-central India and some isolated pockets of northeast India.

According to the IMD, average rainfall in India is most likely to be normal (83-117 percent of long period average) in March. Below normal rainfall is expected in most areas of northwest India, west-central India and some parts of east and northeast India. Normal to above-normal rainfall is likely over most parts of peninsular India, east-central India and some isolated pockets of northeast India.  Similarly, the El Nino year of 2007 also did not result in a drought, with rainfall at normal levels. However, all instances of drought in India over the last 20 years have been in El Nino years. In 2022, a scorching heat wave in March reduced wheat yield in the north and central Indian states. India produced 106.84 million tonnes of wheat in the 2021-22 crop season — less than the 109.59 million tonnes produced in 2021.

Similarly, the El Nino year of 2007 also did not result in a drought, with rainfall at normal levels. However, all instances of drought in India over the last 20 years have been in El Nino years. In 2022, a scorching heat wave in March reduced wheat yield in the north and central Indian states. India produced 106.84 million tonnes of wheat in the 2021-22 crop season — less than the 109.59 million tonnes produced in 2021.